Securing Your Canadian Mortgage as an International Buyer: The 2026 Definitive Guide

Your 2026 Gateway to Canadian Homeownership

The dream of owning property in Canada continues to attract global attention. With its stable economy, high quality of life, and vibrant multicultural cities, Canada presents a compelling case for international buyers and investors. However, navigating the path to homeownership, particularly securing a mortgage, has become a complex endeavor. As we look towards 2026, the landscape is shaped by evolving regulations, a dynamic housing market, and specific lending criteria that demand careful preparation. This guide is designed to be your definitive resource, cutting through the complexity to provide a clear, actionable roadmap for securing a Canadian mortgage as an international buyer in 2026.

The Shifting Sands of Canada’s Housing Landscape for International Buyers

The Canadian real estate market is in a state of flux. After years of rapid price appreciation, the market has entered a period of recalibration influenced by higher interest rates and government interventions. For international buyers, this presents both challenges and opportunities. While affordability remains a key concern in major metropolitan areas like Toronto and Vancouver, the evolving market conditions require a nuanced strategy focused on strong financial standing and a deep understanding of the current rules of engagement. Success in 2026 hinges not just on finding the right property, but on mastering the mortgage acquisition process first.

Understanding Canada’s Policy & Regulatory Environment for Foreign Buyers in 2026

Before approaching any lenders, it is critical to grasp the regulatory framework governing foreign ownership of residential property in Canada. The Federal Government has implemented significant measures that directly impact your ability to purchase and finance a home.

The Prohibition on the Purchase of Residential Property by Non-Canadians Act (Foreign Buyers Ban)

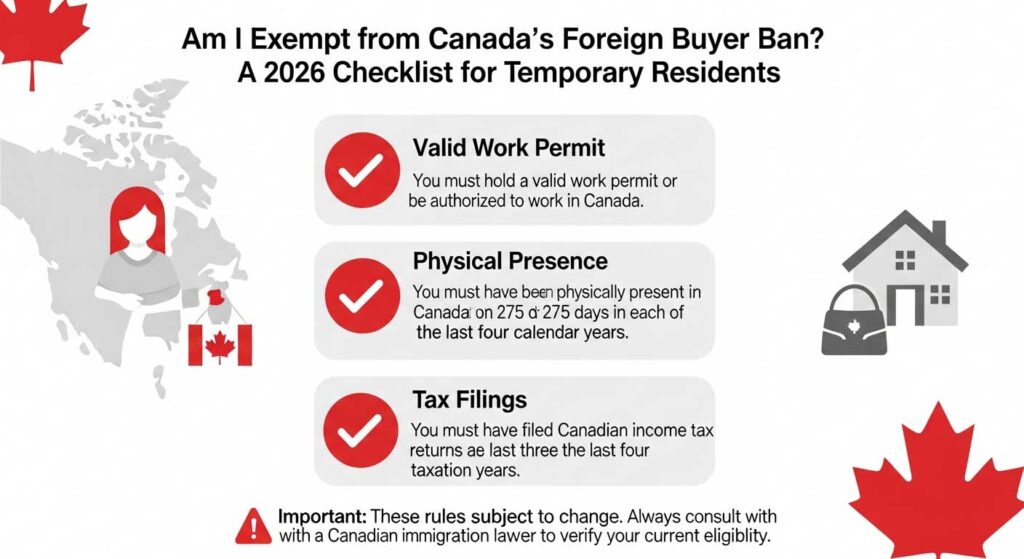

Use this checklist to quickly assess if you meet the key exemption criteria for temporary residents under the Foreign Buyer Ban.

Initially implemented in 2023 and extended, the Prohibition on the Purchase of Residential Property by Non-Canadians Act remains a cornerstone of federal policy heading into 2026. This act restricts non-Canadians from purchasing residential real estate. However, crucial exemptions exist. The regulations provide pathways for certain individuals, such as temporary residents on work permits who meet specific criteria regarding their stay and tax filing history in Canada. It’s vital to verify your eligibility under the most current version of these exemptions before beginning your property search. A misstep here can halt the entire process, making legal consultation an essential first step.

Provincial and Municipal Taxation: Non-Resident Speculation Tax (NRST) and Land Transfer Taxes

Beyond federal rules, provincial taxes add another layer of cost. In Ontario, for example, the Non-Resident Speculation Tax (NRST) is a significant tax levied on the purchase price of a home by foreign nationals, foreign corporations, or taxable trustees. As of the latest regulations, this tax is set at a substantial percentage of the property’s value. Similar taxes exist in other provinces like British Columbia. These taxes are paid at closing and must be factored into your budget, as they are separate from your down payment and cannot be financed through your mortgage.

Federal Government Initiatives and Their Impact on Housing Supply

The Federal Government continues to roll out initiatives aimed at increasing housing supply and improving affordability. While many of these programs are targeted at Canadian residents, they indirectly affect the market international buyers operate in. Policies encouraging new construction could, over time, ease supply constraints in high-demand areas. Understanding these broader market dynamics helps in making strategic investment decisions, particularly for investors looking at long-term ownership and appreciation.

Navigating 2026 Mortgage Qualification Rules for International Buyers

Canadian lenders assess international buyers through a lens of heightened scrutiny. Your application must be comprehensive and meticulously prepared to meet their stringent criteria, which often go beyond the standard requirements for domestic borrowers.

OSFI’s Evolving Mortgage Rules for 2026 and Their Specific Implications

The Office of the Superintendent of Financial Institutions (OSFI) sets the guidelines for federally regulated lenders. In recent years, OSFI has focused on managing risks associated with high household debt and the housing market. For international buyers, especially investors, this translates into stricter stress tests and more rigorous income verification. Lenders will carefully analyze the viability of your application, particularly if you plan to rely on rental income to qualify for your mortgages.

Down Payment Requirements: Beyond the Basics

For non-residents, the minimum down payment is significantly higher than for Canadians. While residents may qualify with as little as 5%, international buyers should expect to provide a minimum down payment of 35% of the purchase price. Some lenders may require up to 50%. The source of these funds is also heavily scrutinized. You must provide a clear paper trail demonstrating that the funds are yours and not from a non-arm’s-length source. Lenders will typically require 90 days of bank statements to verify the history of your down payment funds.

Income Verification for Non-Canadian Borrowers

Proving your income is one of the most critical steps. Lenders need to see stable, verifiable income from reliable sources. This typically includes:

- An employment letter from your current employer stating your position, salary, and tenure.

- Recent pay stubs and tax returns from your country of residence.

- For self-employed individuals, financial statements for your business and personal tax assessments for the last two to three years. All documents not in English or French must be translated by a certified translator.

Mortgage Default Insurance for Foreign Nationals

In Canada, mortgages with a down payment of less than 20% require mortgage default insurance. However, these insured mortgages are generally not available to non-residents. This is the primary reason why the minimum down payment is set at 20% or, more commonly, 35% for international buyers. This policy ensures that lenders are protected against default without relying on insurance, placing the onus on the borrower to have substantial equity in the property from day one.

Differentiated Eligibility: Work Permit Holders, Permanent Residents, and Dual Citizens

Your status in Canada directly impacts your mortgage options.

- Permanent Residents: You are treated the same as Canadian citizens for mortgage purposes and can access the full range of products, including insured mortgages with lower down payments.

- Work Permit Holders: You may be eligible for more favorable terms than a typical non-resident, especially if you have a strong employment history in Canada and have been filing Canadian taxes. Some lenders may offer programs with down payments as low as 5-10%, subject to specific conditions.

- Dual Citizens: You are considered a Canadian citizen for mortgage qualification and have access to all domestic lending programs.

The Mortgage Application Process: A Step-by-Step Guide for International Buyers

A systematic approach is essential for a successful mortgage application. Following a clear, structured process will minimize stress and improve your chances of approval.

Finding Your Mortgage Professional and Lender

Not all lenders work with international clients. The major Canadian banks often have dedicated “New to Canada” programs, but their criteria can be rigid. A mortgage broker who specializes in financing for non-residents is an invaluable asset. They have access to a wider range of lenders, including credit unions and alternative financiers who may offer more flexible solutions tailored to your unique circumstances.

Achieving Mortgage Pre-Approval: An Essential First Step

Before you begin searching for a residential property, secure a mortgage pre-approval. This involves submitting your preliminary financial information to a lender, who will then provide an estimate of the mortgage amount you could qualify for. A pre-approval demonstrates to real estate agents and sellers that you are a serious buyer and gives you a clear budget to work with.

Required Documentation for Mortgage Submission

Prepare to assemble a comprehensive file of documents. This will typically include:

- Valid passport and visa/work permit.

- Proof of down payment (bank statements for the last 90 days).

- Income verification documents (employment letter, pay stubs, tax returns).

- A Canadian bank account.

- A credit report from your home country (Equifax or TransUnion are preferred where available).

- The signed Agreement of Purchase and Sale for the property.

Understanding Mortgage Payments and Future Renewal

Your mortgage payments will consist of principal and interest. You will choose a term (typically 1-5 years) during which your interest rate is fixed or variable. At the end of the term, you must renew your mortgage. It is crucial to maintain a strong financial profile and a good payment history to ensure you can secure a favorable rate upon renewal, especially in a fluctuating interest rate environment.

Beyond the Standard: Alternative Financing & Strategic Opportunities for International Investors

For some international investors, traditional bank financing may not be the best or only option. Exploring alternative strategies can unlock different opportunities.

Exploring Vendor Take-Back (VTB) Mortgages

A Vendor Take-Back mortgage is when the seller of the property provides some or all of the financing to the buyer. This can be a useful tool when traditional lenders are hesitant or to bridge a gap in funding. For an international buyer, a VTB can simplify the process, though the interest rates may be higher than those from a conventional lender.

Opportunities for Investment Property and Rental Income

Canada’s growing population fuels strong demand in the rental market, especially in major urban centers. Investors can leverage this by purchasing properties designed to generate rental income. When assessing your mortgage application, some lenders will consider a portion (typically 50%) of the projected rental income from the property, which can significantly boost your borrowing capacity.

Special Considerations for Property Types and Developments

Lenders have different rules for different property types. A mortgage for a standard single-family home in an established neighborhood is often simpler to secure than one for a pre-construction condominium or a large, unique property. Be aware that some new developments may have restrictions on the percentage of units that can be sold to foreign buyers.

The True Cost of Canadian Property Ownership: Beyond the Mortgage

Your mortgage payment is just one piece of the financial puzzle. Understanding the full spectrum of costs associated with property ownership is essential for accurate budgeting.

One-Time Closing Costs for International Buyers

These are expenses paid upon closing the real estate transaction and can amount to 3-5% of the purchase price, not including the NRST. They include:

- Land Transfer Tax: Levied by the province and, in some cases, the municipality (like Toronto).

- Legal Fees and Disbursements: For the lawyer who handles the transaction.

- Property Appraisal Fee: Required by the lender to confirm the value of the property.

- Home Inspection Fee: Highly recommended to identify any potential issues with the property.

Ongoing Property Ownership Costs and Tax Implications

After taking ownership, you will be responsible for recurring costs:

- Property Taxes: Paid annually to the municipality.

- Home Insurance: Mandatory for all mortgage holders.

- Utilities: Hydro, heat, water.

- Condominium Fees: If applicable.

- Income Tax on Rental Income: Net rental income earned in Canada must be reported to the Canada Revenue Agency (CRA), and income tax must be paid.

Strategic Property Selection and 2026 Market Insights

Making an informed decision in the 2026 market requires a blend of financial readiness and strategic market analysis.

Canada’s Housing Market Outlook for 2026

Experts anticipate that the housing market will continue to stabilize. Potential interest rate moderation could stimulate demand, but affordability challenges will persist. Population growth will remain a key driver, supporting property values and rental demand over the long term. Focus on properties in areas with strong economic fundamentals, good infrastructure, and population growth.

Smart Investment Strategies for the Current Landscape

For investors, cash flow is paramount. Analyze potential properties not just for appreciation potential but for their ability to generate positive monthly rental income after all expenses are paid. Consider diversifying beyond the core of Toronto and Vancouver to other growing metropolitan areas where entry prices may be lower and rental yields higher.

Building Your Essential Support Network: Professionals for International Buyers

Navigating this process alone is not advisable. Assembling a team of qualified professionals based in Canada is the single most important step you can take.

The Indispensable Mortgage Professional

A knowledgeable mortgage broker specializing in non-resident financing is your most crucial ally. They will guide you through the complex lender requirements, help you package your application for the best chance of success, and advocate on your behalf to secure the most favorable terms for your mortgages. Their expertise can save you time, money, and significant frustration.

Conclusion

Securing a mortgage in Canada as an international buyer in 2026 is a challenging but achievable goal. Success is built on a foundation of thorough preparation, a deep understanding of the evolving regulations, and a robust financial profile. The landscape, governed by measures like the Prohibition on the Purchase of Residential Property by Non-Canadians Act and stringent criteria from lenders, demands a strategic and informed approach.

Your key takeaways should be:

- Verify Eligibility First: Confirm you are exempt from the foreign buyer ban before proceeding.

- Prepare for a Large Down Payment: A minimum of 35% is the standard. Ensure funds are seasoned and traceable.

- Meticulously Document Your Finances: Your income and credit history will be under a microscope.

- Budget Beyond the Mortgage: Account for substantial closing costs, taxes like the NRST, and ongoing ownership expenses.

Your next steps should be to engage with a team of Canadian professionals. Start by consulting with a mortgage broker who specializes in non-resident applications. They will be your guide through the entire financing process. Simultaneously, seek advice from a real estate lawyer to understand the legal and tax implications of your purchase. With the right team and a well-prepared strategy, you can confidently navigate the Canadian real estate market and achieve your goal of property ownership.