Vaughans Overpricing Trap: Why Setting Your Price Too High Will Cost You a Fortune

Don’t Fall into the Vaughan Pricing Trap

When selling your home in Vaughan, the goal is simple: achieve the highest possible sale price in the shortest amount of time. It’s a goal that naturally tempts many sellers to set their initial asking price high, hoping to land a spectacular offer or at least leave room for negotiation. But this common impulse is the first step into a costly financial snare known as the overpricing trap. In today’s dynamic Vaughan real estate market, setting your price too high is not just a strategic misstep; it’s a decision that can cost you a fortune in time, money, and opportunity.

The Allure of a High Price: Why Sellers are Tempted

Every seller believes their home is special. Years of memories, personal upgrades, and emotional investment create a perceived value that often exceeds the market’s objective assessment. This emotional attachment, combined with news of record-breaking sales from a previous, hotter market, can lead to wishful thinking. The strategy seems logical: “price high, and we can always come down.” Sellers feel it gives them an edge, a buffer for negotiations, and a shot at a windfall.

The Stark Reality of Overpricing in Today’s Vaughan Market

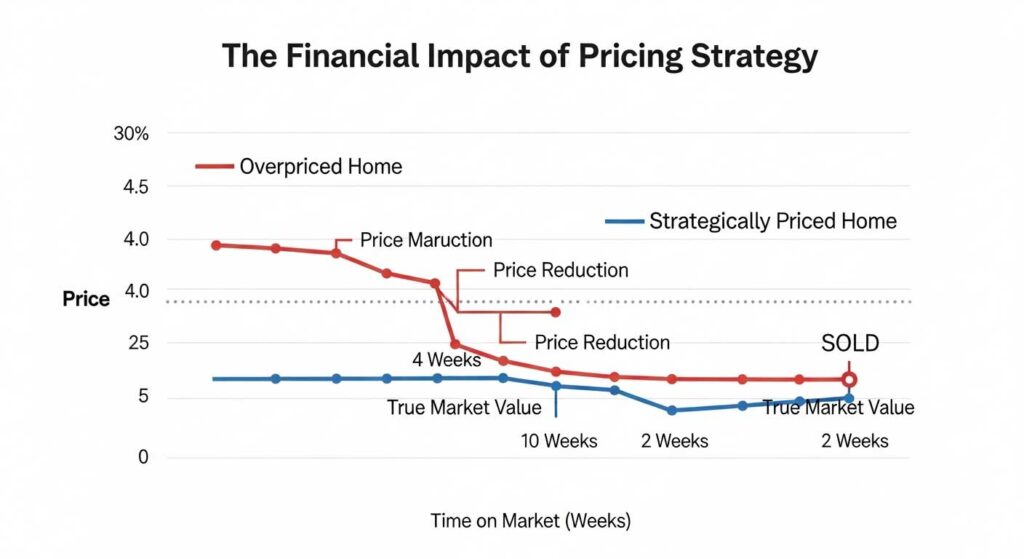

Overpricing (red line) often leads to prolonged market time and price cuts, resulting in a final sale price lower than that of a strategically priced home (blue line).

The reality is starkly different. An overpriced property doesn’t attract high offers; it repels them. In a market that is showing signs of cooling, buyers are more discerning and data-savvy than ever. They have access to comparable sales data and can quickly identify a home that is priced above its true market value. Instead of seeing a premium property, they see an unrealistic seller. The result isn’t a negotiation—it’s silence. The very buyers you want to attract will simply ignore your listing.

What You’ll Learn: Uncovering the Hidden Costs of an Overpriced Home

This article will dismantle the myth of pricing high. We will explore the shifting conditions of the Vaughan real estate market and reveal why this strategy is riskier than ever. You will learn about the immediate disadvantages that cause an overpriced home to be dead on arrival, the long-term financial consequences that lead to selling for less than you should have, and the psychological reasons sellers fall into this trap. Most importantly, we will outline a proven strategy for pricing your home correctly to ensure a successful, profitable sale.

The Shifting Sands of the Vaughan Market: Why Overpricing is Riskier Than Ever

Pricing strategy isn’t a static formula; it must adapt to current market conditions. The Vaughan real estate market of today is not the same as it was a year or even six months ago. Ignoring this evolution is the primary reason why overpricing has become such a financially perilous tactic for home sellers.

Current Vaughan Market Conditions: A Snapshot

The Vaughan market is transitioning. While demand remains for well-priced properties, the frenetic pace has subsided. Inventory levels are adjusting, and buyers now have more options and, consequently, more power. This “market cooling” means properties are staying on the market longer, and the days of guaranteed multiple-offer scenarios on any listing are gone. Buyers are patient and analytical, looking for fair value rather than scrambling to get into the market at any price.

The End of the “Rising Tide” Phenomenon

During the market’s peak, a “rising tide lifts all boats” mentality prevailed. Sellers could price their home aggressively, confident that the rapidly appreciating market would soon catch up to their aspirational number. That tide has now receded. Today, the market will not rise to meet an inflated price. Instead, an overpriced property sits isolated while correctly priced homes around it attract interest and sell.

How Overpricing Exacerbates Market Challenges

In a balanced or cooling market, overpricing acts as an accelerant for all the existing challenges. When buyers have more choices, they apply stricter filters. An inflated price tag immediately disqualifies your property from their search. It makes your home a tool for other real estate agents, who use it as an example of poor value to make their own properly-priced listings look more attractive to potential buyers.

The Immediate Disadvantages: Why Overpriced Homes Are Dead on Arrival

The most critical period for a new listing is the first two to three weeks. This is when it receives maximum exposure on real estate platforms and captures the attention of the most motivated buyers. Overpricing your home squanders this golden window, creating a series of immediate and damaging disadvantages.

The Buyer’s First Filter: Missing Out on Exposure and Interest

Modern buyers begin their search online. They set a specific price range in their search filters based on their budget and what the market dictates for the type of home they are looking for. If you price your property even slightly above the logical bracket for its size, location, and condition, you become invisible to the largest pool of qualified buyers. They will never even see your listing, and you can’t sell a home to someone who doesn’t know it exists.

Lack of Showings: The Silence is Costly

The direct result of being filtered out is a deafening silence. A lack of showing requests in the crucial first weeks is the market’s clear feedback that your price is out of sync with its perceived value. Buyers are voting with their feet—by staying away. This initial lack of activity is a major red flag that often marks the beginning of a long and frustrating selling process.

No Competitive Offers: Undermining Your Negotiating Power

The ultimate goal of a smart pricing strategy is to generate enough interest to create competition among buyers. This is what drives the price up and gives you, the seller, maximum negotiating leverage. When you overprice, you eliminate the possibility of a multiple-offer situation. Instead of buyers competing against each other, you are left hoping for a single, often low, offer from a buyer who senses your desperation.

The Perceived Value Problem: Why Buyers Question High Prices

An overpriced home makes savvy buyers and their agents suspicious. They wonder, “What is the seller thinking?” or “Is there something wrong with this property that I’m not seeing?” Rather than seeing it as a premium home, they may perceive the seller as unreasonable or difficult to work with. This negative perception can deter them from even considering the property, regardless of its actual merits.

The Long-Term Consequences: The Costly Cascade of Overpricing

The initial damage of overpricing quickly snowballs into a series of long-term consequences, each one further eroding your property’s value and your final net proceeds. The fortune you hoped to gain is slowly lost through a predictable and painful cascade of events.

The “Stale Listing” Syndrome: What a Long DOM Signifies

As your home sits on the market, its “Days on Market” (DOM) count rises. In real estate, a high DOM is a stain. Buyers become wary of properties that have been for sale for a long time, assuming there must be a hidden defect or that it’s simply undesirable. This stigma, known as the “stale listing” syndrome, makes your home less attractive, even after you eventually reduce the price.

The Inevitable and Demoralizing Price Reductions

To combat the lack of interest, you will be forced to implement price reductions. This is a reactive, not proactive, strategy. You are no longer controlling the narrative; you are chasing the market down. Each price drop is a public admission that you were initially wrong, which weakens your negotiating position. Buyers who were once watching from the sidelines will now wait, assuming more reductions are coming, and will eventually submit offers that are even lower than your new asking price.

The True Financial Loss: Selling for Less Than Initial Market Value

Here is the ultimate irony of the overpricing trap: sellers who price too high often sell for less than they would have if they had priced their home correctly from the start. By the time they have gone through several price reductions and the property is stigmatized, they often have to accept an offer below true market value just to get it sold. This loss, combined with months of carrying costs—mortgage payments, property taxes, insurance, and utilities—is how overpricing truly costs you a fortune.

Appraisal Issues and Mortgage Hurdles for Buyers

Even if you find a buyer willing to pay your inflated price, the deal can still collapse. The buyer’s lender will require an independent appraisal to ensure the property is worth the loan amount. If the appraiser determines the home’s value is lower than the agreed-upon price, the lender will not approve the mortgage. This often leads to the deal falling apart, forcing you to put your now-stale listing back on the market.

Unpacking the “Why”: The Psychology Behind Overpricing Your Vaughan Home

Understanding the solution requires understanding the problem’s root cause. Sellers don’t overprice their homes with malicious intent; they do so based on a blend of emotion, misinformation, and misguided expectations.

Emotional Attachment and Overvaluation of Upgrades

You’ve poured your heart, soul, and savings into your home. The kitchen renovation you lovingly designed or the garden you spent years perfecting holds immense personal value. Unfortunately, buyers don’t share that emotional connection. While quality upgrades add value, sellers often overestimate their return on investment, pricing their home based on what they spent rather than what the market is willing to pay.

Misinterpreting Past Market Performance and Wishful Thinking

Hearing about a neighbour’s incredible sale price six months ago can create a powerful anchoring bias. Sellers anchor their expectations to that peak number, failing to recognize that the market has since shifted. This “rear-view mirror” approach ignores current data, inventory levels, and buyer sentiment, leading to a price based on a market that no longer exists.

The “Rising Tide” Mentality: Ignoring Current Trends

As mentioned earlier, the belief that the market will simply rise to meet any price is a dangerous holdover from a more frenzied period. In a stabilizing or cooling market, this mentality is a recipe for failure. A successful sale requires a strategy that respects the current trend, not one that hopes for a return to the past.

The Pitfalls of Misguided Realtor Advice

Unfortunately, not all real estate advice is created equal. Some agents may suggest an inflated price to “buy the listing”—telling a seller what they want to hear to secure their business, knowing they can push for price reductions later. This unethical practice sets sellers up for the painful cycle of disappointment and financial loss described above.

The Solution: Strategic Pricing for Maximum Return in the Vaughan Market

Avoiding the overpricing trap doesn’t mean underselling your home. It means employing a deliberate, data-driven strategy designed to position your property to attract the maximum number of qualified buyers and achieve its highest possible market value.

The Cornerstone of Success: A Professional Comparative Market Analysis (CMA)

The most reliable tool for setting the right price is a comprehensive Comparative Market Analysis (CMA) prepared by a local real estate expert. A CMA goes beyond simple online estimates, analyzing recently sold properties that are truly comparable to yours in location, size, condition, and features. It also considers active listings (your competition) and expired listings (examples of what not to do) to identify a precise, justifiable price range.

Understanding the “Pricing Pyramid” and Buyer Behavior

Imagine a pyramid. At the very top, representing a price 10-15% above market value, you attract only a tiny fraction of potential buyers. As you move down the pyramid to the market value price, the pool of interested buyers grows significantly. Pricing slightly below market value, at the base of the pyramid, exposes your property to the largest possible audience. This strategy is designed to generate a surge of initial interest, leading to multiple showings and the competitive offer situation that ultimately drives the final sale price up, often above the asking price.

Adjusting Your Strategy for Current Vaughan Market Conditions

A smart pricing strategy is dynamic. In the current Vaughan market, it means pricing at or just slightly ahead of the market to stand out. It requires a deep understanding of local micro-trends. Your real estate professional should be able to tell you how properties like yours are performing right now and adjust the strategy accordingly to maximize exposure and interest.

Partnering with a Knowledgeable Vaughan Real Estate Expert

The key to navigating this complex process is partnering with a real estate professional who prioritizes an honest, data-backed strategy over telling you an inflated number just to win your business. A true expert will provide a detailed CMA, explain the pricing pyramid, and help you position your home to win in today’s market conditions. They are your shield against the financial pitfalls of the overpricing trap.

Conclusion: Price Smart, Sell Strong, and Avoid the Vaughan Pricing Trap

The desire to get top dollar for your Vaughan home is understandable, but the path to that goal is counterintuitive. It is not paved with an inflated asking price and wishful thinking. In reality, that approach leads directly to the overpricing trap—a costly cycle of stagnation, price reductions, and ultimately, a lower final sale price.

The single most profitable decision a seller can make is to set an accurate, market-driven price from day one. A strategic price is a magnet for buyers. It generates immediate interest, encourages showings, creates competition, and preserves your negotiating power. It protects your home from the stigma of a stale listing and prevents the financial drain of extended carrying costs.

To implement this winning strategy, your first step should be to consult with a trusted Vaughan real estate expert. Demand a comprehensive, data-driven analysis of your property’s value in the context of today’s market. By pricing smart, you can sell strong, avoid the trap, and ensure you walk away with the true fortune your valuable property deserves.